Section 54F Exemption on residential house acquired abroad

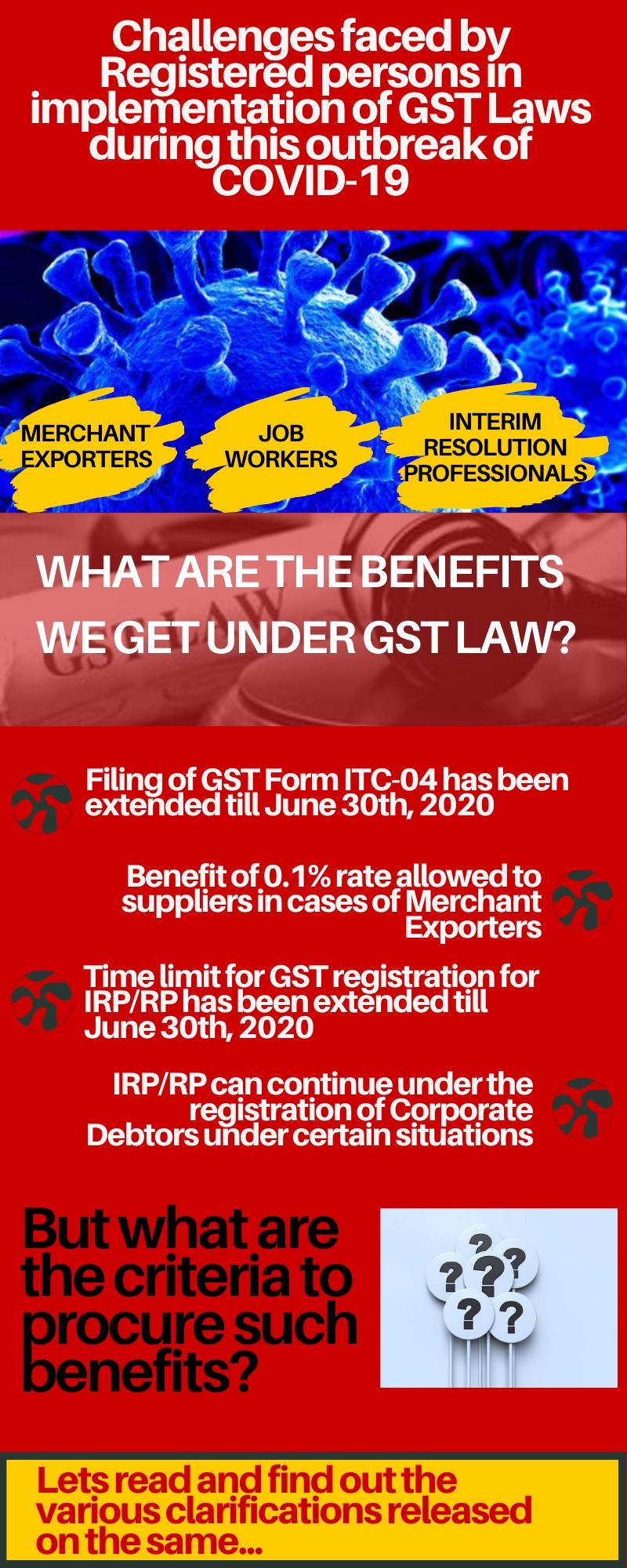

The COVID -19 situation has been rising in the country and has put majority of the people into a dilemma. The more concerning situation is to the meeting of various statutory requirements laid down by various acts and the fear of paying penalties on non-compliance. Hence, the government came up with various relaxations for those who need them to avoid further losses due to the pandemic.

However, with regard to the recently released Notifications with respect to GST, there has been various queries raised by few as to whether they are eligible for the same. The government then came up with Circulars to clarify such queries and help businesses. One such Circular released on 6th of May 2020, issued by the CBIC (Circular no. 138/08/2020-GST), guides in clarifying the issues related to the Merchant Exports, Job Work and The Insolvency and Bankruptcy Code that need to file returns in Form GST ITC – 04 for the quarter ending March 2020 for which the due date is 25th of April 2020.

Merchant Exports

If a merchant exporter exports goods within 90 days from the date of issue of Tax Invoice by Registered Suppliers, a benefit of 0.1% rate is allowed to the supplier.

Under what circumstances is the time limit for Merchant exporters has been extended till June 30th?

Clarification – The same gets extended till 30th June 2020 only if the completion of such 90 days from the date of issue of Tax invoice falls within the time frame of 20.03.2020 to 29.03.2020.

Return for Job Work

Any return of Job work in respect of goods dispatched to a job worker for the quarter ending March 2020 falls within 25th April 2020, it is deemed to be extended till 30th June 2020.

Whether the date to furnish the details of any return of Job work has been extended as well?

Clarification – The due date for furnishing such details in Form GST ITC-04 for the quarter ending March 2020 has been extended up to 30th June 2020.

Insolvency and Bankruptcy Code, 2016

1. Any Interim Resolution Professional (IRP)or Corporate Interim Resolution Professional (CIRP) is required to take a separate GST registration within 30 days from the date of Issuance of the notification.

As the whole country is under lockdown, there is difficulty in obtaining registrations. Can there be an extension?

Clarification – An IRP/CIRP will need to obtain the GST registration either within 30 days from the date of Issuance of Notice or by 30th June 2020, whichever is later

2. Any IRP/RP in respect of any Corporate Debtor, is required to take a new GST registration with effect from the date of appointment.

If I am already a Corporate Debtor complying with all the provisions laid out by the GST Law, which means I have filed all GSTR-3Bs prior to the period of any appointment, is there a required to be registered again?

Clarification – An IRP/CIRP if have filed all Form GSTR-1 and GSTR-3B without any defaults in filing prior to the period of appointment, need not require to obtain a fresh GST registration and can continue under the registration of the Corporate Debtor.

3. Due to certain circumstances, even without the ratification of an appointed IRP, a separate RP is appointed

Can the same GSTIN be transferred or will both need to take fresh registrations?

Clarification – The following two situations can arise:-

Disclaimer:“The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation.”

Please share:

Prepared By

Sushama Mohandasan

CA Final

Date:27/06/2020