GST NOTIFICATION DATED 29TH JANUARY 2019 WHICH ARE EFFECTIVE FROM 1ST FEBRUARY 2019

2019 Notifications are issued by the department from time to time to keep the concerned people updated regarding changes made by the department with regard to various compliance procedures, tax rates, and similar matters.

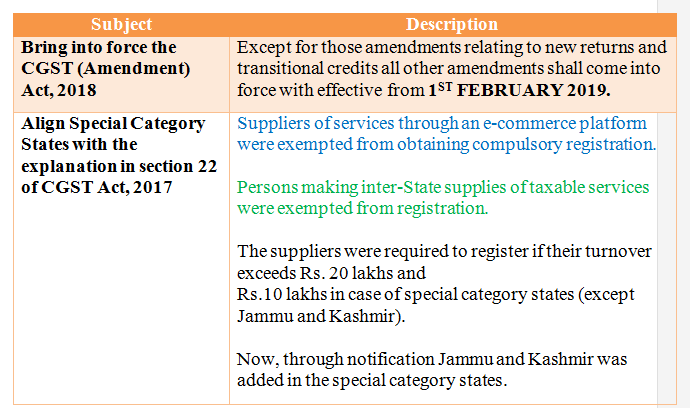

GST Council in its 32nd meeting held at New Delhi made many recommendations.In line with decisions taken on 32nd GST Council Meeting held on 10th January 2019, CBIC issued 13 GST Notifications in this respect.

In line with decisions taken on 32nd GST Council Meeting held on 10th January 2019, CBIC issued 13 GST Notifications in this respect.

Below is List of notifications issued on 29-01-2018 by CBEC whivh shall come into force from 01-02-2019.

Disclaimer:"The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation."

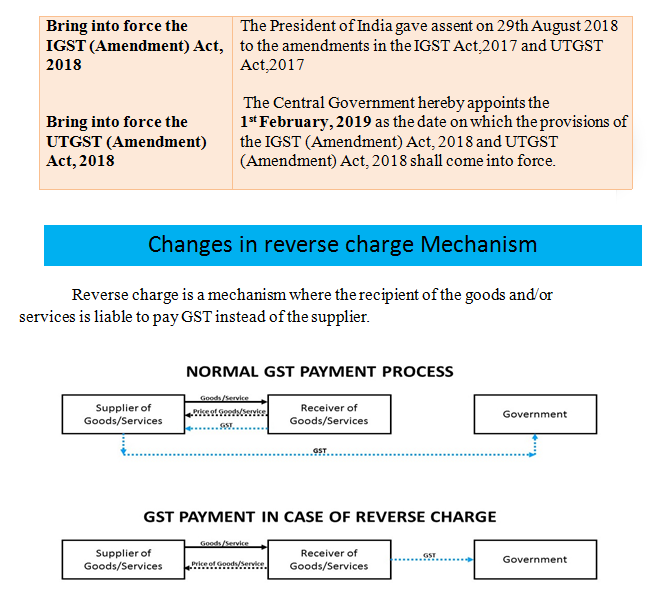

Supply From An Unregistered Dealer To A Registered Dealer

If a vendor who is not registered under GST, supplies goods to a person who is registered under GST, then Reverse Charge would apply. This means that the GST will have to be paid directly by the receiver to the Government instead of the supplier.

Earlier Provision:

Reverse Charge Mechanism in case of supplies made by unregistered persons to registered persons deferred to 30th Sept 2019.

Latest Update as on 1st Feb 2019

Reverse Charge Mechanism in case of supplies made by unregistered persons to registered persons will apply, starting from 1st Feb 2019, only on specified goods/services and specified persons.

Till the date neither class of registered persons nor specified categories of goods prescribed by the Government. So until and unless notified RCM will not applicable.

Prepared By

Vinay Kumar N

Happy to Help you

Contact :

Ankit C Shetty

ankit@bchsettyco.com